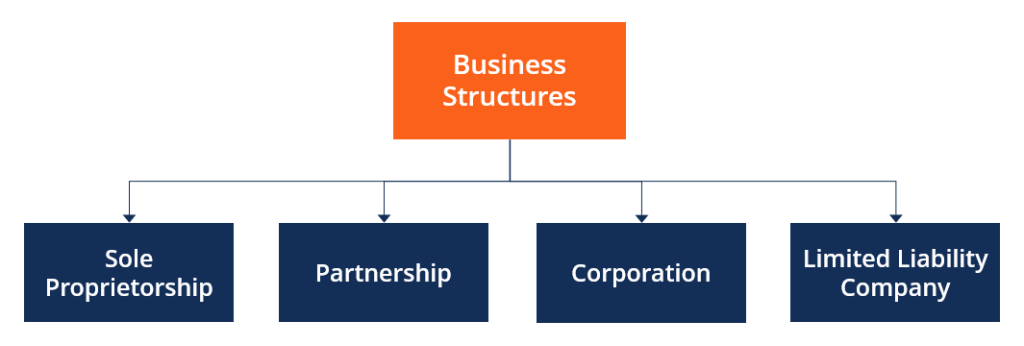

Choosing the right business structure is one of the most critical decisions for any business owner. Whether you’re starting a new venture or reevaluating your existing business, the structure you select can have significant implications on your taxes, liability, and overall success. In this article, we explore why having the correct business structure matters and how to determine if your current setup is right for your business needs.

The Australian Taxation Office (ATO) has been tightening its focus on rental property owners, targeting common errors that lead to incorrect deductions and underreporting of rental income. With data-matching tools and extensive audits, the ATO aims to ensure compliance and prevent taxpayers from making costly mistakes.

Here’s what you need to know to stay compliant and avoid penalties

Navigating the complexities of business tax can be challenging, especially for small and medium-sized enterprises. Many businesses make common tax mistakes that can lead to significant financial penalties or missed opportunities for savings. At SKD Accountants, we're committed to helping you optimize your tax strategy and avoid costly errors. In this article, we’ll explore the top tax mistakes businesses make and how you can steer clear of them.

Top Tips When Starting A Business From An Accountant

Starting a small business in Australia is an exciting yet challenging journey, and getting your finances right from the start is crucial. At SKD Accountants, we specialise in helping new businesses establish a strong financial foundation. Below, we share our top accounting tips to ensure your business starts off on the right foot.

As the we approach the end of the second month of the current financial year. We would like to shed some insight into how businesses can evaluate their current financial standing and chart a course for the future. It is ideal for setting new goals, reflecting on past performance, and making strategic decisions that will contribute to sustainable growth.

Capital Gains Tax (CGT) in Australia can significantly impact your financial outcomes when selling assets. However, with the right strategies, you can effectively manage and reduce your CGT liability. Whether you’re an investor, property owner, or business owner, understanding CGT and planning ahead can lead to substantial savings.

The Importance of Budgeting for Small Businesses: A Path to Financial Success

Budgeting is essential for small businesses, offering a

roadmap to financial stability and growth. At SKD Accountants, we understand

that many small business owners struggle with financial management, cash flow

forecasting, and profit maximisation. A well-structured budget is the

foundation for success, helping businesses control expenses, plan for the

future, and make informed decisions. Here’s why budgeting is crucial for your

small business and how it can position you for long-term success.

Creating a business budget is essential for managing your finances, driving growth, and ensuring long-term success. Whether you’re just starting out or have been in business for years, a well-structured budget provides insight into your company’s financial health and allows you to make informed decisions. At SKD Accountants, we specialize in helping businesses develop financial strategies that fuel growth and sustainability.

Running a successful small business is no small feat. Between managing daily operations and planning for the future, it’s easy to feel overwhelmed. One of the best ways to keep your business on the path to success is by creating a solid financial roadmap. With clear goals and proactive financial planning, you can navigate challenges, optimise growth, and build a resilient business. At SKD Accountants, we specialise in helping Melbourne small businesses develop the financial roadmaps they need to thrive. Let’s dive into the key steps to building yours.

As cryptocurrency continues to grow in popularity, understanding how it is taxed in Australia is essential. The Australian Taxation Office (ATO) actively monitors cryptocurrency transactions to ensure compliance, and failing to meet your obligations can result in penalties. This guide explains the key tax rules for cryptocurrency investors and traders.

As we usher in 2025, small business owners have a prime opportunity to reflect on past achievements and challenges, and to strategically plan for the year ahead. Effective preparation is crucial for sustainable growth and success. Here are five essential tips to guide your business planning for 2025

The structure of your business is a cornerstone of its success. A well-chosen structure supports growth, efficiency, and financial health. On the other hand, an unsuitable structure could lead to unnecessary costs, limited asset protection, and tax inefficiencies over time. As your business evolves, it’s important to reassess whether your current structure still meets your needs.

Property investment is one of the most effective strategies for building wealth in Australia, not only due to its potential for capital growth but also because of the associated tax benefits. To maximise the advantages of your investment, it’s essential to understand what expenses can be claimed and how to minimise your tax liability. Here’s an overview of the tax benefits available to property investors and how to make the most of them.

Effectively managing your business debt is critical to ensuring financial stability and paving the way for sustainable growth. Whether it’s short-term obligations or long-term commitments, the right approach can transform debt from a challenge into an opportunity.

Why Start Early? When should you begin planning your business exit strategy? Ideally, before you even launch your business. While that may sound premature, having a clear vision for your endgame ensures that every decision you make—from business structure to financial planning—aligns with your long-term goals. If you’ve been running your business for years without considering an exit strategy, don’t worry. The second-best time to start is today.

Choosing the right accountant can have a profound impact on your business’s success. But how do you know if your current accountant is the right fit for your growing needs? Here are some of the most common reasons businesses in Australia decide it’s time to make a change, and how upgrading to the right accounting partner can unlock your business’s full potential.

As cryptocurrency continues to revolutionize the financial world, businesses are increasingly exploring the option of accepting digital payments. While embracing crypto offers exciting opportunities, understanding the accounting and tax implications is crucial for smooth integration. In this blog, we’ll cover how businesses can manage crypto payments, navigate Goods and Services Tax (GST) obligations, and unlock the advantages of accepting digital currency.

Running a successful business involves more than just tracking profits and expenses. To ensure long-term stability and growth, businesses need to regularly assess their overall financial wellbeing. This is where a financial health check comes in. A financial health check provides a comprehensive review of your business’s financial position. It helps identify strengths, weaknesses, risks, and opportunities, giving you the clarity needed to make informed decisions. Here’s everything you need to know about financial health checks and why your business should schedule one.

Investing in property through a Self-Managed Super Fund (SMSF) has become an increasingly popular strategy among Australians looking to diversify their retirement savings. While it offers several advantages, there are also important risks to consider. In this article, we explore the key benefits and potential pitfalls of SMSF property investments to help you make an informed decision.

Having strong revenue and profits is a sign that your business is on the right track. However, it’s important to continuously make small changes to improve profitability and ensure long-term success. Here are some practical ways to enhance your cash flow and maintain financial health.

Dealing with the financial and legal affairs of a deceased loved one can be challenging and overwhelming. Understanding how deceased estates work and the key steps involved can help ease the process. In this blog, we cover everything you need to know about deceased estates in Australia, including tax obligations and essential considerations.

Fringe Benefits Tax (FBT) is a key consideration for any Australian employer offering benefits beyond base salaries. Staying on top of FBT compliance not only minimises costly penalties but also ensures your business remains in good standing with the Australian Taxation Office (ATO). In this comprehensive guide, we’ll walk you through an essential FBT compliance checklist that every employer should know.

Estate planning is a crucial but often overlooked aspect of managing a Self-Managed Superannuation Fund (SMSF). While many SMSF trustees focus on growing their retirement savings, failing to plan for how superannuation benefits will be distributed upon death can result in tax liabilities, legal disputes, and financial hardship for beneficiaries.

The ATO has announced a significant change that will affect many Australian businesses and individuals from 1 July 2025. Under the new rule, interest charged by the ATO on overdue tax debts will no longer be tax-deductible. This is a big shift — especially for small business owners who often use short-term deferrals as a way to manage cash flow. If you’ve previously relied on claiming interest on late tax payments as a deduction, this change could increase your out-of-pocket costs. Here's what you need to know and how you can prepare.

Tax planning is the strategic organisation of your financial affairs to legally minimise your tax liability. It involves understanding current tax laws, leveraging available deductions, offsets, and structures, and making smart financial decisions throughout the year – not just at tax time.

As we edge closer to the end of the financial year, tax planning becomes more than just a compliance requirement—it’s a real opportunity to maximise savings and boost your long-term financial position. At SKD Accountants, we’re passionate about helping clients make smart, strategic decisions. Here’s a real-life case study of how we helped a client save thousands in tax with some well-timed planning before 30 June.

In recent years, the Instant Asset Write-Off has been one of the most popular tax planning tools for small and medium businesses across Australia. But as we settle into 2025, many business owners are asking the question: Is it still worth it? The answer, as always with tax, is: It depends. Let's take a closer look.

As we approach the end of the 2024–2025 financial year, now is the perfect time to sit down with your accountant and review your tax planning strategy. Proactive tax planning can help you reduce your tax liability, maximise deductions, and improve your overall financial health.

Whether you’re a startup founder, a solo entrepreneur, or a small business owner wearing multiple hats, understanding your finances can be the difference between thriving and barely surviving. One of the most common financial misconceptions we see is the confusion between cash flow and profit. While both are crucial indicators of business health, they serve very different purposes—and knowing how to interpret them could be what saves your business from a financial blindspot.

Cash flow problems are one of the biggest challenges facing Australian small businesses today. Whether you're a tradie, a startup founder, or running a family business, the stress of not knowing whether you can pay your bills next month can be overwhelming. But here’s the good news. With smart cash flow forecasting, you can take back control of your finances before things spiral out of hand.

If you're like many small business owners, managing cash flow can feel like juggling fire. One minute everything’s running smoothly; the next, you're scrambling to cover payroll or a supplier invoice. The good news? A few strategic tweaks can make a big impact quickly. Here are 6 cash flow quick wins you can implement now to create breathing room and boost your financial stability.

Cash flow isn’t just a line on your financial reports, it’s the oxygen that keeps your business alive. If you’ve ever had to delay paying a supplier or worried about covering wages, you already know how critical it is. For Australian small businesses, managing cash flow well can be the difference between sustainable growth and sudden closure. While profit tells you if your business is viable, cash flow shows whether your business is survivable.

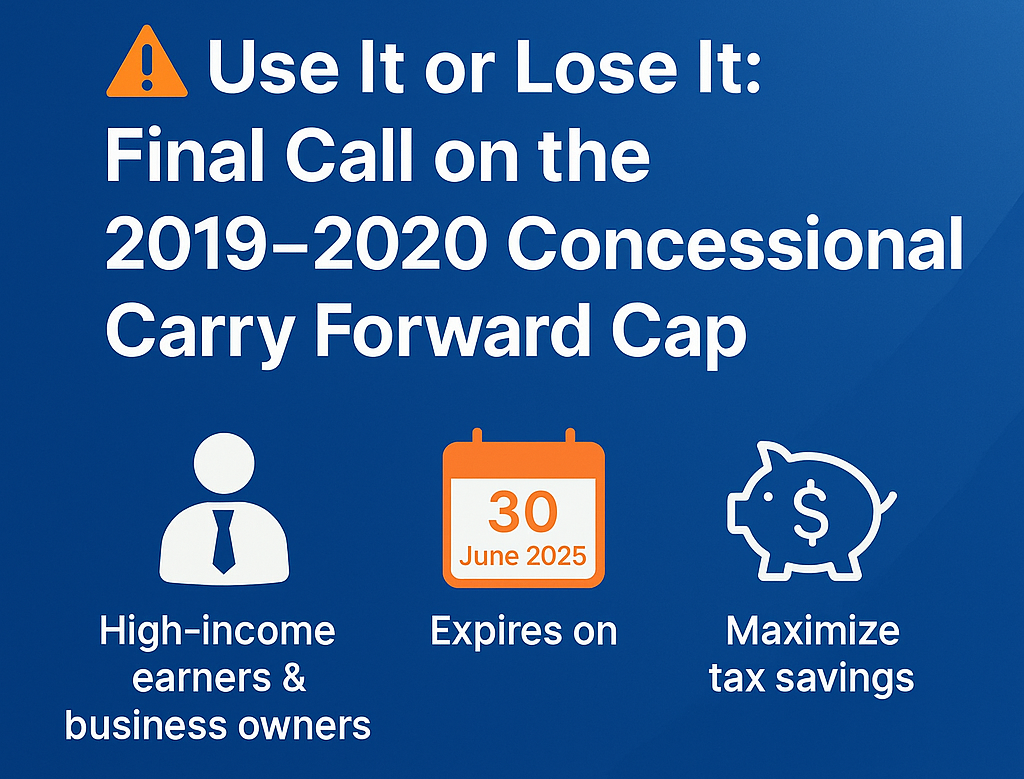

If you're a high-income earner or a business owner, this tax saving opportunity may be flying under your radar and time is running out. The 2019–2020 unused concessional superannuation cap is set to expire on 30 June 2025. If you're eligible and haven't used your full cap for that year, this is your last chance to top up your super tax effectively and potentially save thousands in tax.